Quote-to-Cash Made Simple: Your Field Guide to Faster Sales and Scalable Revenue Growth

Table of Content

- Why Quote-to-Cash Matters for Growth

- The Impact of a Connected Quote-to-Cash Platform

- How does this impact different businesses?

- Understanding the Quote-to-Cash Process

- The Six Core Stages of Quote-to-Cash

- Core Capabilities for Scalable Quote-to-Cash

- Scaling Strategies for Different Business Types

- Key KPIs to Measure Quote-to-Cash Performance

- Best Practices for Scaling Quote-to-Cash

- Final Thoughts

- FAQs

Every business selling a product or service follows a journey before it receives revenue. This journey begins when a customer shows interest, passes through pricing and approvals, continues to fulfillment, and ends with payment received and recorded.

This full journey is known as the quote-to-cash (Q2C) process.

Key Takeaways:

- Quote-to-cash is not a single workflow but a connected revenue system spanning sales, operations, and finance.

- Disconnected tools slow deals, introduce errors, and delay cash collection.

- Speed at the quoting stage has a compounding impact on approvals, fulfillment, and payment timelines.

- Approval delays and system handoffs are among the most common causes of stalled revenue.

- Integrated CPQ, CRM, procurement, invoicing, and analytics eliminate rework and improve visibility.

- Cash flow improves when invoicing and payments are triggered automatically from clean quote data.

- Analytics turn quote-to-cash into a continuous improvement engine.

- Scalable growth requires standardizing processes before increasing volume or complexity.

- Quote-to-cash performance should be measured using end-to-end KPIs, not isolated metrics.

- A connected platform transforms quote-to-cash from an operational burden into a competitive advantage.

In reality, most B2B businesses struggle because quoting exists in one system, customer data in another, and approvals and invoicing elsewhere. Each handoff introduces delay, manual work, and risk.

This guide defines quote-to-cash in clear, practical terms. It divides the process into precise stages, identifies where businesses lose time and profit, and demonstrates how a unified Q2C platform, such as VARStreet, transforms collaboration between sales, operations, and finance teams. Use this guide to identify your own bottlenecks and start transforming your Q2C process today.

Why Quote-to-Cash Matters for Growth

For sales-driven organizations, whether you are a Value Added Reseller (VAR), distributor, manufacturer, service provider, or B2B eCommerce seller, growth depends on one critical factor.

How efficiently you move from customer interest to collected revenue.

A slow or fragmented quote-to-cash process leads to tangible challenges for businesses, reducing revenue growth, undermining sales efficiency, and creating roadblocks that affect customer satisfaction and profitability.

- Slow quotes reduce win rates because buyers rarely wait.

- Pricing mistakes weaken trust and reduce margins.

- Approval delays stretch sales cycles unnecessarily.

- Fulfillment issues frustrate customers.

- Late invoicing slows cash flow.

- Disconnected systems create duplicate work and poor visibility.

A well-structured quote-to-cash process allows teams to respond to customers faster, provide more accurate pricing, fulfill orders efficiently, and collect payments sooner. These benefits eliminate unnecessary friction, leading to faster sales cycles, better cash flow, increased customer trust, and a significant competitive advantage that drives long-term, scalable growth.

The Impact of a Connected Quote-to-Cash Platform

With disconnected tools, the quote-to-cash process feels fragmented as teams jump between systems and re-enter data manually.

A connected quote-to-cash platform changes this experience.

VARStreet unifies quoting, eCommerce, CRM, procurement, invoicing, and analytics into one workflow. Information flows from one stage to the next without rework.

How does this impact different businesses?

- VARs and manufacturers respond to quote requests faster and win deals earlier.

- Service providers reduce contract disputes and billing confusion.

- B2B eCommerce sellers deliver orders faster and shorten payment cycles

The key message: A connected quote-to-cash process is essential for scalable revenue growth. It accelerates sales, enhances accuracy, and strengthens enduring customer relationships across industries. Start evaluating your current Q2C workflow and consider implementing an integrated solution for better results.

Understanding the Quote-to-Cash Process

Quote-to-cash extends beyond a basic sales workflow. It serves as the operational bridge between the customer’s purchase intent and the point of revenue recognition.

Each step in this process builds confidence or creates friction. Manual work or disconnected systems cause delays. When connected, each step reinforces the next.

Although each industry has its own variations, the core stages of quote-to-cash remain consistent.

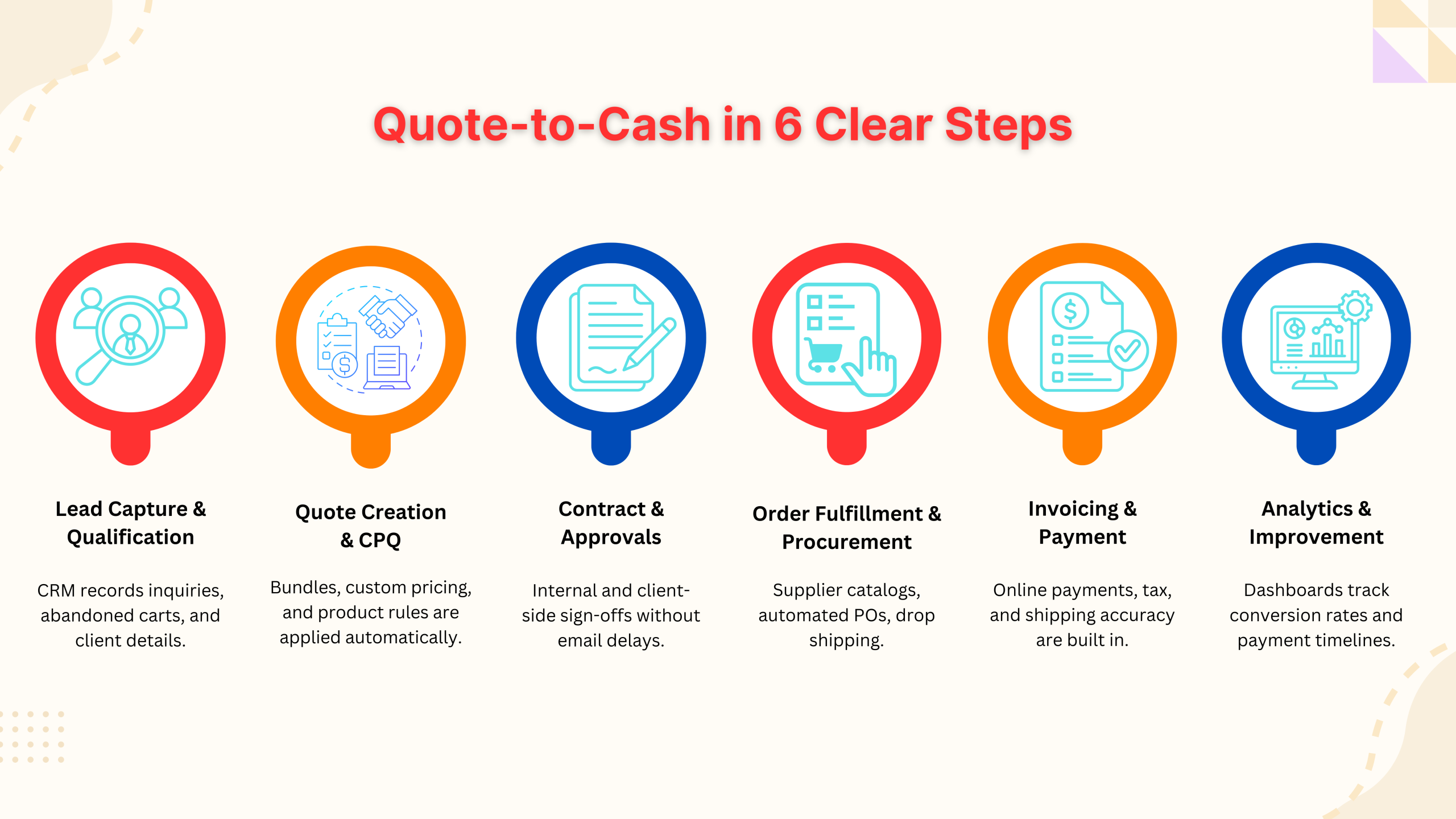

The Six Core Stages of Quote-to-Cash

1. Lead Capture and Qualification

The process begins when a potential customer submits a request, browses a storefront, abandons a cart, or contacts the sales team directly.

If these signals are missed, opportunities are lost. An integrated CRM stores every inquiry, links it to customer data and sales activity, and helps teams prioritize follow-ups with context.

When lead capture is connected, businesses benefit from fewer missed sales opportunities, faster customer responses, and clear visibility into the sales pipeline, which directly contributes to higher conversion rates and greater revenue potential.

2. Quote Creation and Configuration (CPQ)

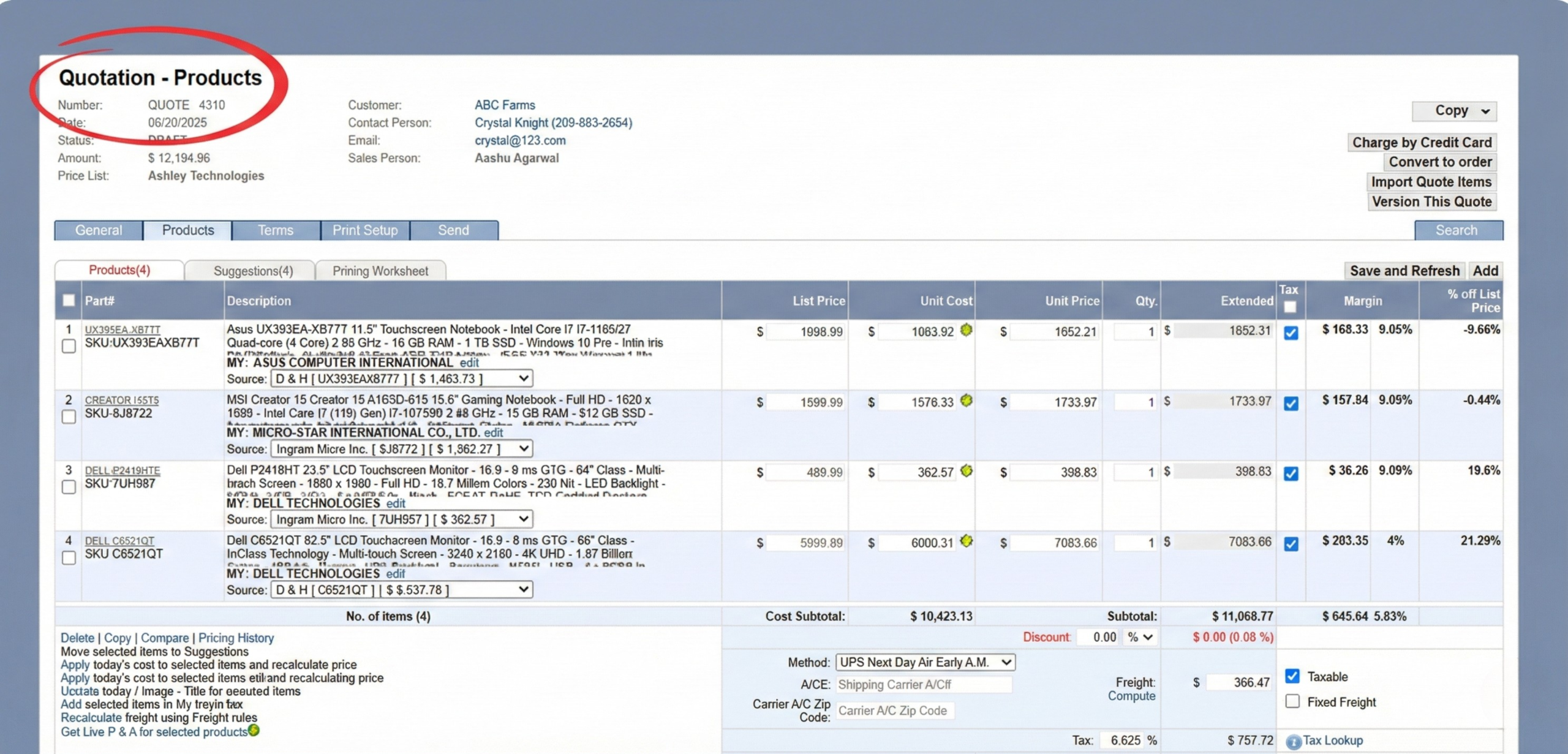

In B2B sales, quoting is rarely simple. Quotes may include bundled products, licenses, services, contract pricing, or special discount rules.

CPQ tools automate pricing and configuration. Sales generate accurate quotes faster and avoid manual recalculation. Quotes move directly into orders.

What improves when this stage is connected:

Shorter quote turnaround times, fewer pricing errors, and smoother order conversion.

3. Contract Management and Approvals

Many B2B quotes require approval or a formal contract. Manual approval chains slow deals and increase the risk of errors or missed steps.

Automated approval workflows route contracts quickly to the right stakeholders. eSignature lets customers approve documents online without delays.

Connecting approvals and contract management means faster sales cycles, fewer stalled deals, and better compliance tracking, giving businesses greater control and reduced operational risk.

4. Order Fulfillment and Procurement

After approval, procurement confirms availability, sources products, and coordinates delivery. Delays are common if this stage operates outside the quoting system.

With supplier catalog connectivity and real-time pricing, teams check inventory instantly and issue purchase orders efficiently. Drop shipping speeds up fulfillment.

When fulfillment and procurement are aligned, businesses experience reduced sourcing delays, improved inventory accuracy, and faster customer deliveries—ensuring expectations are consistently met.

5. Invoicing and Payment

Revenue is recognized only when the invoice is issued and paid. In many businesses, invoicing happens late because order details must be re-entered into accounting systems.

Integrated invoicing and payment workflows remove friction. Automated tax calculations, online payments, and instant invoice generation speed cash collection. A connected invoicing and payment stage means improved cash flow, fewer billing mistakes, faster payment cycles, and a better experience for both the business and its customers.

6. Analytics and Continuous Improvement

Every quote-to-cash cycle produces data. When scattered across tools, insights are lost. When unified, data powers improvement.

Dashboards reveal how long it takes to convert quotes, where approvals slow down, which products perform best, and which customers pay the fastest. Teams use these insights to refine pricing, processes, and sales strategies. When analytics are connected, businesses gain better forecasting, data-driven decision-making, and continuous optimization of sales and revenue processes, allowing for rapid pinpointing and resolution of bottlenecks.

Common Bottlenecks Businesses Face

Despite having capable teams, many organizations face similar quote-to-cash challenges:

- Manual quoting that delays responses

- Pricing errors that erode customer confidence

- Approval bottlenecks that extend sales cycles

- Payment delays that strain cash flow

- Disconnected systems that force duplicate work

A complete quote-to-cash process includes six connected stages: lead capture, quoting, contracting, fulfillment, invoicing, and analytics. Businesses that streamline all six consistently see faster deal cycles, fewer errors, and stronger cash flow.

Core Capabilities for Scalable Quote-to-Cash

Scaling revenue requires more than increased speed. It necessitates connecting each part of the sales journey, preventing slowdowns as volume, complexity, and customer expectations grow.

VARStreet brings quoting, eCommerce, CRM, procurement, analytics, and integrations into a single platform. Each capability supports a specific stage of the quote-to-cash process, but the real value lies in how they work together.

1. Advanced Quoting and CPQ

Advanced quoting and CPQ sit at the heart of the quote-to-cash process.

The quoting engine allows teams to create everything from simple one-line quotes to complex packages that include hardware, software, services, and contract pricing. CPQ logic automatically applies pricing rules, ensuring consistency across sales teams.

Sales reps no longer need to check pricing sheets or manually revalidate calculations. Bundles, discounts, and configurations are handled inside the system, reducing errors and speeding up quote creation.

Example:

A VAR preparing a quote for a school district can bundle laptops, operating system licenses, warranties, and setup services into one quote. A manufacturer can configure a custom parts order without cross-checking multiple spreadsheets or price lists.

2. Integrated CRM

For IT resellers and B2B sellers, quoting and customer management cannot live in separate silos.

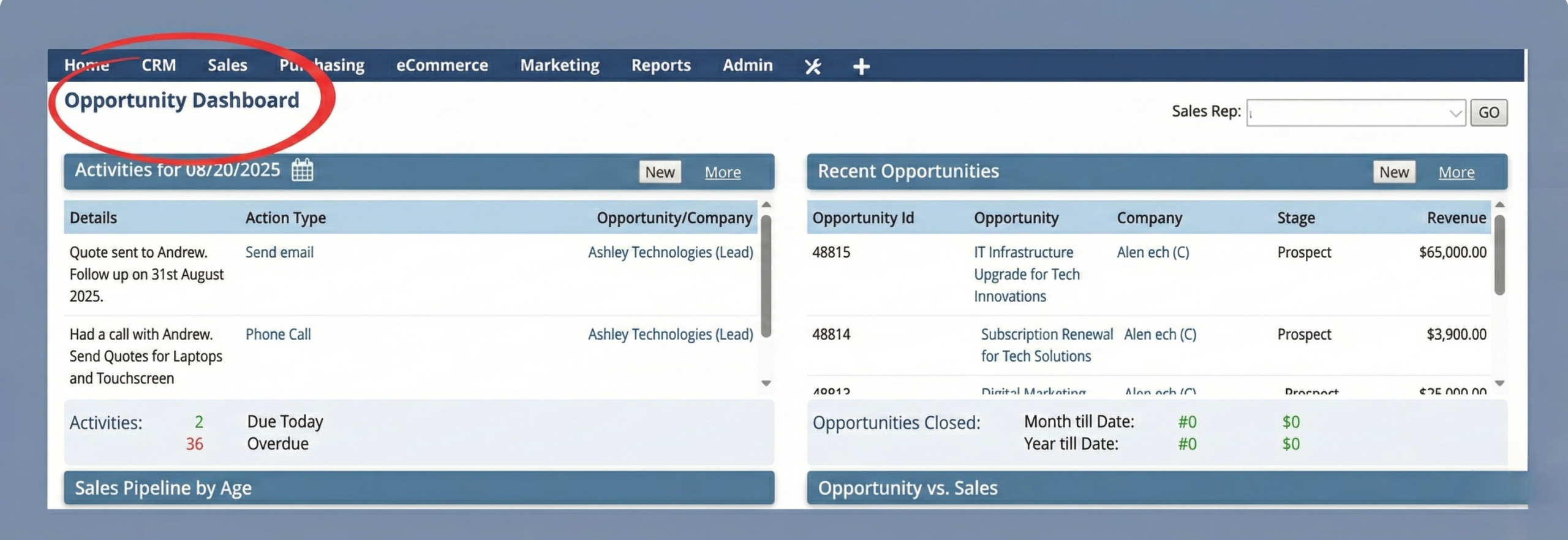

VARStreet’s built-in CRM connects every lead, opportunity, and customer interaction directly to the quoting process. When a prospect requests a quote, that activity is automatically added to the sales pipeline.

Online inquiries, abandoned carts, and repeat orders all flow into the CRM. Sales teams can see deal value, stage, and history without switching tools.

This tight integration eliminates manual data entry, reduces the risk of missed follow-ups, and ensures every quote is part of a structured sales cycle.

Example:

A service provider notices a client browsing specific packages in their portal. The sales rep follows up with a tailored quote based on that activity, improving conversion chances.

3. eCommerce and Customer Portals

Modern B2B buyers expect self-service options, especially for repeat purchases.

VARStreet enables businesses to create public or private storefronts with customer-specific pricing, product catalogs, and order history. Multiple storefronts can be managed from a single backend, enabling businesses to serve different customer segments efficiently.

Customers can log in, browse approved products, place orders, or request quotes without waiting for manual assistance.

Example:

A distributor runs a wholesale storefront for bulk buyers and a separate portal for smaller customers, both connected to the same inventory and pricing system.

4. Procurement and Supplier Connectivity

Procurement is often where quote-to-cash slows down.

VARStreet connects directly to supplier catalogs, providing real-time pricing and availability. Teams can compare suppliers, issue purchase orders quickly, and automate replenishment when stock runs low.

Drop shipping support allows sellers to deliver directly from suppliers to customers, reducing handling time and inventory costs.

Example:

A reseller compares pricing from multiple distributors before placing a purchase order, ensuring better margins without manual research.

5. PunchOut and System Integrations

Enterprise customers often require PunchOut support so they can shop from your catalog inside their own procurement systems.

VARStreet supports PunchOut catalogs for platforms like SAP Ariba, Coupa, Oracle, and Workday. Customers browse your products from within their system, while orders flow back automatically.

Beyond PunchOut, VARStreet integrates with accounting, ERP, and CRM tools such as QuickBooks, Salesforce, NetSuite, and Microsoft Dynamics. APIs ensure data stays consistent across departments.

Example:

A manufacturer integrates its catalog with a large enterprise client’s procurement system, enabling fast, frictionless reorders.

6. RMA and After-Sales Service

The quote-to-cash process does not end at delivery.

VARStreet includes built-in RMA workflows for returns, repairs, and refunds. Customers submit requests through a clear process, and internal teams track resolution without confusion.

Efficient after-sales handling protects customer trust and reduces support overhead.

Example:

A retailer issues store credit immediately upon approval of a return, keeping the customer engaged while the item is being processed.

7. Analytics and Business Intelligence

Analytics turn quote-to-cash into a continuous improvement system.

Custom dashboards show quote conversion rates, approval delays, payment timelines, and customer behavior. Leaders use these insights to identify bottlenecks, adjust pricing strategies, and improve forecasting accuracy.

Example:

A service provider tracks which proposals close fastest and refines their sales approach based on real data.

Key takeaway:

These capabilities work together to remove friction, improve accuracy, and give teams full visibility from quote to payment.

Scaling Strategies for Different Business Types

Every industry approaches sales differently, but quote-to-cash challenges are often similar. The difference lies in how each business uses Q2C capabilities to remove friction and scale.

1. Value Added Resellers (VARs)

For VARs, speed determines success.

Traditionally, resellers spent hours moving between distributor portals, checking pricing, and manually compiling quotes. Customers waited while competitors moved faster.

With aggregated supplier catalogs and CPQ, VARs can pull live pricing from multiple distributors and generate bundled quotes in minutes. Quotes convert directly into purchase orders without rework.

This faster quoting-to-order flow helps VARs consistently win deals when timing matters most.

2. Distributors

Distributors manage large catalogs and diverse customer groups.

A centralized catalog ensures pricing and SKUs stay accurate. Multi-storefront support enables distributors to serve different customer segments efficiently. PunchOut integration makes repeat ordering nearly automatic for enterprise clients.

This reduces manual processing and strengthens long-term customer relationships.

3. Manufacturers

Manufacturers often quote products that are configurable or custom-built.

CPQ tools help manage complex configurations without losing pricing control. Private portals allow key accounts to reorder approved products at contract pricing.

Orders flow directly into ERP systems, supporting production planning and scheduling.

4. Service Providers

Service businesses rely on accurate proposals, renewals, and billing.

Integrated quoting and CRM help prepare detailed service proposals while maintaining customer history. Online payments and automated invoicing improve cash flow and reduce follow-up effort.

5. B2B eCommerce Sellers

B2B eCommerce sellers benefit from flexibility.

Customer-specific catalogs ensure buyers see only approved products and negotiated pricing. Marketplace integrations extend reach while orders flow back into the same fulfillment system.

Takeaway:

While workflows differ, the goal is the same. Shorten the path from interest to payment, keep every step connected, and make it easier for customers to buy again.

Key KPIs to Measure Quote-to-Cash Performance

Improving quote-to-cash is not possible without measurement. Clear KPIs help teams understand where the process is working well and where friction still exists. These metrics connect daily activity to revenue outcomes and cash flow.

1. Quote Turnaround Time

This KPI measures how quickly your sales team can generate and send a quote in response to a customer request. Shorter turnaround times signal efficiency and responsiveness. Long delays often indicate manual steps, pricing confusion, or approval bottlenecks. Faster quotes usually lead to higher win rates.

2. Quote-to-Order Conversion Rate

This metric tracks how many quotes turn into confirmed orders. A strong conversion rate suggests accurate pricing, clear proposals, and buyer confidence. A low rate often points to pricing issues, slow follow-ups, or approval friction.

3. Average Deal Cycle Time

This measures the total time from first customer interaction to final payment. Shorter deal cycles improve cash flow and forecasting reliability. Long cycles usually indicate delays in contracts, procurement, or invoicing.

Pro Tip:

Use cycle-time analytics to continuously refine the quote-to-cash process and improve cash flow.

4. Discount Approval Turnaround

This KPI focuses on how quickly discount requests are reviewed and approved. Faster approvals keep deals moving and reduce buyer frustration. Slow approvals increase the risk of losing deals to competitors.

5. Revenue Leakage Percentage

Revenue leakage occurs when expected revenue is lost due to pricing errors, missed renewals, incorrect invoices, or contract mismatches. Tracking this KPI helps businesses identify gaps and protect profitability.

6. Customer Satisfaction

Customer experience is closely tied to quote-to-cash performance. Fast, accurate, and professional quotes improve trust and loyalty. Dissatisfaction often shows up as delayed decisions or lost repeat business.

7. Forecast Accuracy

This measures how closely projected revenue matches actual results. Higher accuracy means sales data is reliable, and leadership can plan confidently. Poor accuracy often signals weaknesses in the quote-to-cash process.

Best Practices for Scaling Quote-to-Cash

Scaling quote-to-cash is not only about adopting the right platform. It is about using it consistently and intentionally across teams.

1. Automate Wherever Possible

Use CPQ rules to apply pricing and bundles automatically.

Set up automated purchase orders based on stock thresholds.

Configure approval workflows so quotes and contracts do not stall in inboxes.

2. Centralize Product and Pricing Data

Maintain a single catalog that updates directly from suppliers.

Ensure customer-specific pricing is built into the system so quotes, portals, and invoices stay aligned.

3. Connect Business Systems

VARStreet connects quoting and eCommerce with accounting platforms, including QuickBooks Online and Desktop.

For businesses using ERP or CRM systems, APIs and connectors ensure data flows smoothly across quoting, orders, procurement, and back-office operations.

Link payment gateways, tax tools, and shipping carriers to complete the flow from order to delivery.

Pro Tip:

Establish standardized handoffs between quoting, order management, and billing systems to eliminate bottlenecks.

4. Use eSignature for Faster Approvals

Digital signature tools allow customers to approve quotes and contracts online within minutes. This removes delays caused by printing, scanning, and manual follow-ups while improving the buying experience.

5. Monitor Metrics Regularly

Track quote conversion rates and test improvements in pricing or presentation.

Monitor approval and payment timelines to identify bottlenecks.

Use dashboards to compare performance by product, salesperson, or customer.

6. Build Compliance Into the Process

Keep payment workflows PCI compliant.

Use integrated tax tools to ensure accuracy.

Document and track returns, repairs, and refunds through the RMA system.

Quick tip: Start with one or two automation wins, such as faster approvals or automated purchase orders. Early success builds confidence before expanding further.

Case Study Snapshots

Real-world scenarios help show how a connected quote-to-cash process delivers measurable impact.

VAR Cuts Quote Time by 90 Percent with Live Supplier Sync

A mid-sized VAR serving corporate clients previously spent up to two days preparing a single quote. Sales reps manually compared distributor pricing and re-entered data into quoting tools.

After adopting VARStreet, the team used an aggregated supplier catalog with real-time pricing to build quotes in under two hours. Faster responses helped them reach customers first and close more deals.

Scaling eCommerce to $100 Million Without Operational Chaos

An IT hardware reseller launched an eCommerce storefront for existing customers. Within two years, sales crossed $100 million. By managing quoting, catalog updates, CRM, and procurement in a single platform, the company reduced operational costs and avoided the overhead typically associated with rapid growth.

Manufacturer Simplifies Contract Reorders with Private Portals

A manufacturer handling long-term contracts struggled with reorder requests arriving through scattered emails. Using VARStreet, they created private portals for each client with pre-approved products and contract pricing. Customers reordered directly through the portal, reducing delays and errors while improving fulfillment speed.

Managed IT Provider Expands into Hardware Sales

A managed IT services company bundled hardware with support contracts but invoiced manually after delivery. By integrating quoting, eCommerce, and payment gateways, invoices were issued immediately after contract acceptance. Payment delays dropped by more than 30 percent, improving cash flow and customer satisfaction.

Choosing the Right Quote-to-Cash Platform

A quote-to-cash platform becomes a core operational system. The right choice should support current workflows while allowing for scalability.

Key evaluation areas include:

- Flexible quoting and CPQ for simple and complex pricing

- CRM integration to keep customer and sales data connected

- eCommerce support for public and private storefronts

- Supplier catalog connectivity for real-time pricing and procurement

- PunchOut support for enterprise buyers

- Built-in RMA and after-sales workflows

- Reporting and analytics for performance visibility

- Security, compliance, and tax accuracy

A practical approach is to list your biggest bottlenecks first. Any platform under consideration should solve those before adding advanced capabilities.

Final Thoughts

Every business faces a choice. Continue juggling disconnected tools, waiting days for approvals, chasing suppliers for updates, and sending invoices that take weeks to get paid. Or build a quote-to-cash process that flows smoothly at every step.

A connected platform like VARStreet turns quote-to-cash into a growth engine. CPQ speeds up quoting. Supplier integrations accelerate fulfillment. eCommerce and CRM keep customers engaged. Analytics reveal where to optimize.

For VARs, distributors, manufacturers, service providers, and B2B eCommerce sellers, quote-to-cash is no longer just an operational concern. It is a strategic advantage.

If your goal is faster sales cycles, stronger cash flow, and scalable revenue growth, improving your quote-to-cash process is the most practical place to start.

VARStreet connects quoting, CPQ, eCommerce, CRM, procurement, PunchOut, RMA, and analytics into a single system, enabling businesses to move from quote to payment faster and with confidence.

FAQs

What is quote-to-cash (Q2C)?

Quote-to-cash is the complete business process that starts with customer interest and ends when revenue is collected and recorded. It includes lead capture, quoting, approvals, fulfillment, invoicing, payment, and performance analysis.

Why is quote-to-cash important for revenue growth?

Because revenue is not realized until payment is received, delays or errors at any stage slow cash flow, reduce win rates, and increase operational costs. An efficient Q2C process shortens sales cycles and improves predictability.

What are the most common quote-to-cash bottlenecks?

Typical bottlenecks include manual quoting, pricing errors, slow approval processes, disconnected procurement, late invoicing, and payment delays due to data re-entry or mismatched systems.

How does CPQ fit into the quote-to-cash process?

CPQ automates pricing, configuration, and discount logic during the quoting stage. It reduces errors, speeds up quote creation, and ensures quotes flow cleanly into orders without rework.

How does a connected Q2C platform improve cash flow?

By eliminating delays between quote approval, order fulfillment, and invoicing. When data flows automatically, invoices are issued faster, payment cycles shorten, and billing errors decrease.

Is quote-to-cash only relevant for VARs?

No. While VARs benefit significantly due to complex pricing and supplier relationships, quote-to-cash applies equally to distributors, manufacturers, service providers, and B2B eCommerce sellers.

What KPIs should businesses track for quote-to-cash?

Key KPIs include quote turnaround time, quote-to-order conversion rate, deal cycle length, discount approval time, revenue leakage, forecast accuracy, and customer satisfaction.

Can quote-to-cash improvements scale without increasing headcount?

Yes. Automation and system integration allow teams to handle higher volume and complexity without proportional increases in staffing, enabling scalable growth.

How long does it take to see results from Q2C optimization?

Many businesses see improvements within the first few months, especially in quote speed, approval turnaround, and invoicing timelines. Full impact compounds over time as adoption increases.

What should businesses look for when choosing a quote-to-cash platform?

The platform should address existing bottlenecks first, support flexible quoting and CPQ, integrate with CRM and accounting systems, enable procurement and PunchOut, and provide analytics for continuous improvement.

Pragya Bhardwaj

Pragya Bhardwaj is a seasoned B2B content writer with a strong background in SaaS and digital commerce. She specializes in creating clear, engaging, and search-optimized content that helps businesses connect with their audiences and build authority online. With experience across blogs, whitepapers, eBooks and website copy, Pragya brings both strategy and storytelling to every piece she writes. Editorial Policy

Read More